Pasture Rangeland and Forage (PRF) Insurance

Pasture Rangeland Forage (PRF) Insurance

Oregon | California | Washington | Nevada | Idaho | Arizona | Utah | Montana | Wyoming | Colorado | Texas | Oklahoma | Kansas | South Dakota | North Dakota

Learn more

NO upfront cost

Contact us to enroll for 2025, no premiums due until September 2025!

SIMPLE enrollment process

Our agents make it simple and easy to access this affordable program

PAYS YOU

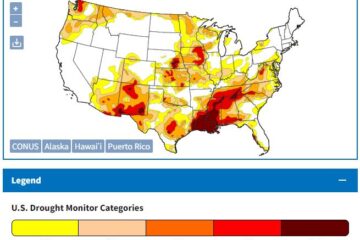

When rainfall is less than 90% of normal based on NOAA

Available on Irrigated & Dry Land Crops

Pasture, rangeland and forage (PRF) acres including alfalfa all qualify.

Available in 48 States!

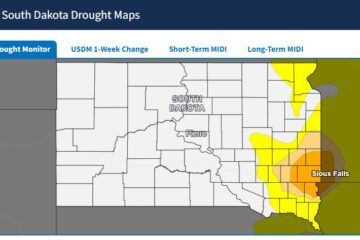

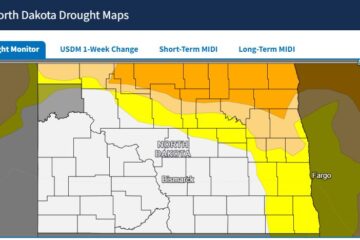

Including Oregon, California, Washington, Nevada, Idaho, Utah, Montana, Wyoming, Colorado, North Dakota, South Dakota, Kansas, Oklahoma, Texas

Affordable Protection Against Lack of Precipitation

This program is USDA Subsidized making it affordable for you!

The Application Deadline for 2025 Coverage is

December 1, 2024!

Enrollment for 2025 is during the Fall of 2024

Fill out the form below and one of our agents will contact you ASAP to discuss your coverage!

Pasture Rangeland and Forage PRF Insurance Program was created to assist in protecting your operation if there is a lack of precipitation. This can impact the growth of your product (or by-product that feeds your animals).

PRF Insurance is very simple, no record keeping or claims required.

How do you choose the proper interval?

You and your Insurance Agent will determine the intervals that are the most volatile and most likely to affect your product that results in a loss. You can select the period that is most important to your operation. For instance, if precipitation in January is important to the beginning process of growing each year and this January is dry (below average precipitation), the PRF Insurance would kick in and cover you for potential loss. That is, if you had the Jan/Feb interval chosen for coverage. You can select a coverage level from 70-90%. You are essentially insuring a rainfall index that is expected to estimate production.

PRF California

PRF Idaho

PRF Nevada

PRF Oregon

Will my crop agent help?

It is important that you work with your crop agent to make decisions on all the different choices to make, such as: coverage level, index intervals, irrigated practice, productivity factor, and the number of acres you wish to insure (as you don’t have to insure all of them). You and your Crop Agent should take a look at the Grid ID Locator map and index grids for your area to determine where to assign acreage on the grid or grids.

We have a team of experienced Crop Agents who are familiar and working with the Pasture, Rangeland, and Forage (PRF) Insurance Program with our customers. Please give us a call to learn more! PRF West is here to help you with you Pasture Rangeland and Forage in Oregon, California, Washington, Arizona, Nevada, Idaho, Utah, Montana, Wyoming, Colorado, Texas, Oklahoma, Kansas, South Dakota and North Dakota. The sales closing date deadline to enroll in the Pasture Rangeland Forage (PRF) Program is December 1st.

Get in touch

Facebook-f

Wpforms

Envelope

Contact us today to learn more about PRF and how it can protect you!

PRF West Insurance Services LLC

Pasture Rangeland Forage | Oregon, California, Washington, Nevada, Idaho, Montana, Utah, Arizona, Wyoming, Colorado, Texas, Oklahoma, Kansas, South Dakota, North Dakota

Contact us

PRF West Insurance Services, LLC.

- Individual Customized Services

- Knowledgeable, caring team